utah tax commission tap

Official site of the Property Tax Division of the Utah State Tax Commission with information about property taxes in Utah. Visit Utahgov opens in new window Services opens in new window Agencies opens in new window Search Utahgov opens in.

Businesses and representatives accountants bookkeepers payroll professionals etc can use TAP to manage their Utah business tax accounts.

. For security reasons TAP and other e-services are not available in most countries outside the United States. If you are not redirected to the TAP home page within 10 seconds please click the button below. 801-297-6800 Toll Free1-888-251-9555 Fax.

Individuals can use TAP to file current year. Due to our efforts to protect your identity please. You are being redirected to the TAP home page.

Ad Tap Tax Utah. Filling gaps in the trail system. We are committed to funding the following.

Except as otherwise provided for by law the interest rate for a calendar year for all taxes and fees administered by the Commission shall be calculated based. Utah State Tax Commission Motor Carrier Services 210 N 1950 W Salt Lake City UT 84134 Phone. Ad Utah Tax Commission information registration support.

If you have questions regarding the education classes or the appraiser designations contact Tamara Melling Property Tax Education Coordinator at 385-377-6080 or tmellingutahgov. Utah Taxpayer Access Point TAP TAP. This requires free registration before using.

This TAP tax is often referred to as a ZAP or RAP tax. Under Send us click Attach. Use Taxpayer Access Point TAP to make any changes online.

Blank Forms Pdf Forms Printable Forms Fillable Forms. Motor Vehicle Enforcement MVED. Official tax information for the State of Utah.

Frequently asked questions about Taxpayer Access Point. Enter the Letter ID provided in the header of the letter you received from the Tax Commission requesting. For many returns that are filed online such as sales or withholding tax you can.

Taxpayer Access Point TAP. TAX COMMISSION CONTACT INFORMATION. In accordance with Utah Code Annotated 59-2-202 each centrally assessed Utility and Transportation taxpayer must annually file on or before March 1 a completed Annual Report.

Please contact us at 801-297-2200 or taxmasterutahgov for more. New State Sales Tax Registration. Utah Taxpayer Access Point TAP TAP.

Easily Download Print Forms From. The Tax Commission cannot issue a refund prior to March 1 unless we have received both your return and your employers required return.

Bill Of Sale Utah State Tax Commission Bill Of Sale Template State Tax Bills

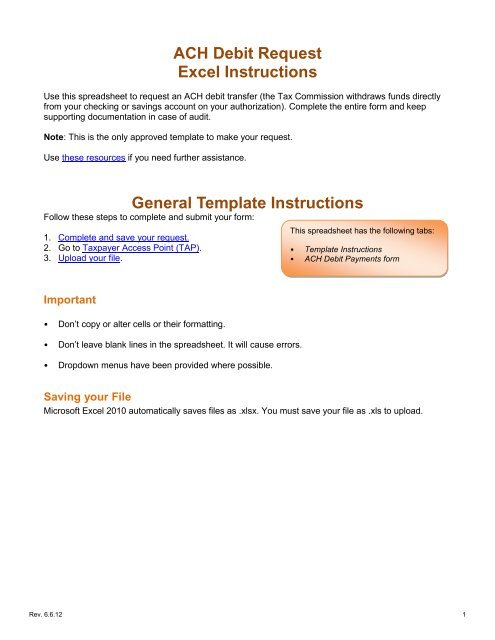

Ach Debit Request Excel Instructions Utah State Tax Commission

Ach Debit Request Excel Instructions Utah State Tax Commission

2022 Budget West Valley City Ut Official Site

How To Winterize Outdoor Faucets Forbes Advisor

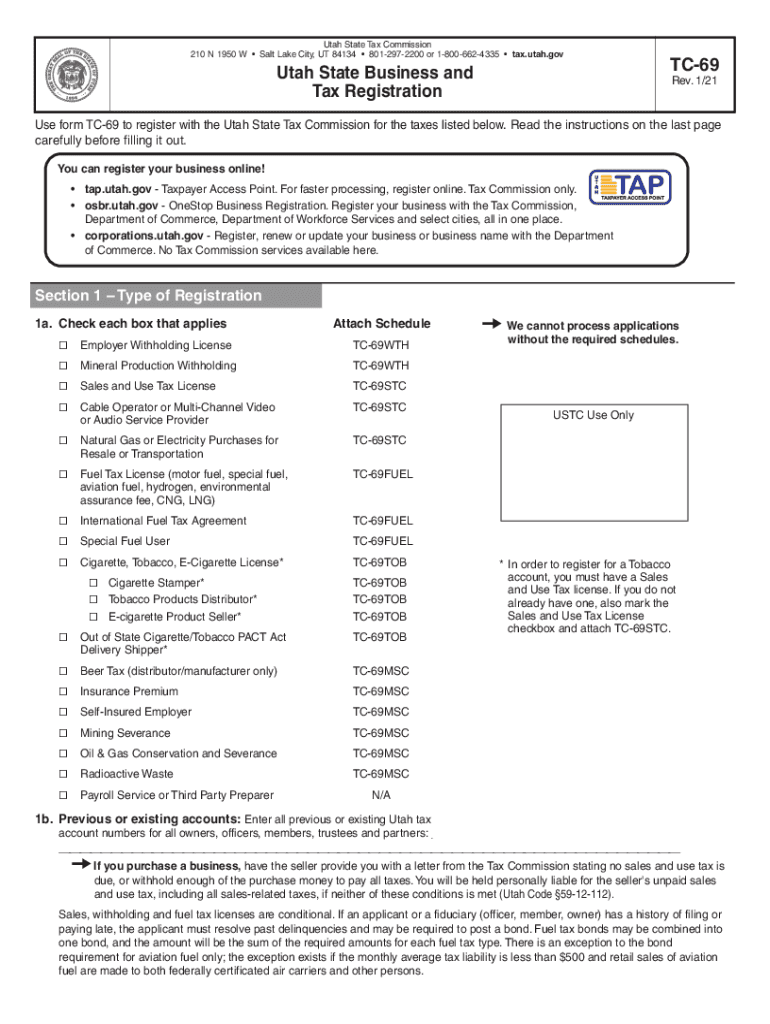

Ut Tc 69 2021 2022 Fill Out Tax Template Online Us Legal Forms

Ach Debit Request Excel Instructions Utah State Tax Commission

Ach Debit Request Excel Instructions Utah State Tax Commission

Ut Publication 17 2018 2022 Fill Out Tax Template Online Us Legal Forms

Ach Debit Request Excel Instructions Utah State Tax Commission

Ach Debit Request Excel Instructions Utah State Tax Commission

Ach Debit Request Excel Instructions Utah State Tax Commission